Enter a whole new world of spending your crypto on the go with the Bybit Card. Not only using this crypto debit card is convenient and reliable, but it’s also a secure and fast way to make the most use of your crypto assets.

You can click here to sign-up for a Bybit account and start exploring more on the Bybit Card and the limitless opportunities that it unlocks.

What is Bybit Card?

The Bybit Card is a virtual Mastercard crypto debit card that lets you access your crypto funds quickly and easily, allowing you to spend your crypto wherever and whenever.

Brought to you by two of the leading innovators in the FinTech space, Bybit and Mastercard, owning a Bybit Card is the perfect way to ensure that you are always digital-ready in everything crypto.

As a reliable and convenient way to off-ramp your crypto and spend on the go, the Bybit Card helps you to maximize and fully integrate crypto into your daily life. With it, you can utilize your earnings from Bybit’s full suite of trading products and pay for your shopping — instantly.

That’s not all. Unlock a world of exclusive benefits with the Bybit Card Loyalty Rewards Program — including rewards from partners such as unique offers and special experiences.

Additionally, the Bybit Card is easy and affordable to maintain. The card has a validity period of three years and its virtual version comes with auto-renewal after expiration. It doesn’t have any annual or dormancy fees. For the virtual version of the card, you’ll also not be charged any card issuance fees or account closure fees. The only fees chargeable are the foreign exchange fees at a rate of 0.5% for EEA and 1% for Australia, as well as a crypto liquidation fee of 0.9% on top of Bybit’s One-Click Sell Exchange Rate.

Advantages of Using Bybit Card

Transacting using your crypto assets shouldn’t be complicated. As such, Bybit has created a way to make life easier for its users through this crypto debit card. The following are some of the unique selling points of the Bybit Card:

Widely Accepted

Over 90 million merchants accept the Bybit crypto debit card. All you need is to shop and pay at stores that display the Mastercard logo. As one of the leading global electronic payment providers, Mastercard has an expansive merchant network around the world.

Bybit’s strategic partnership with Mastercard provides a secure platform for its users to conveniently pay for goods and services using cryptocurrencies.

Wide Variety of Crypto Options

Currently, you can select and pay anytime, with one of the following eight cryptocurrencies using your Bybit Card — Bitcoin (BTC), Ether (ETH), Ripple (XRP), Tether (USDT), USD Coin (USDC), Toncoin (TON), Mantle Network (MNT), and Binance Coin (BNB). The transaction process is fast and straightforward since it is done directly from your Bybit account through an intuitive and user-friendly dashboard. We’re also adding more crypto options and allowing multi-asset spending in a single transaction in the future, so stay tuned for the upcoming developments!

3D Secure EMV

At Bybit, keeping our customers’ funds safe is a priority. It’s based on this principle that we saw Mastercard as a perfect fit since their platform observes strict security standards to prevent loss of funds and customer information.

The Bybit crypto debit card is EMV 3D Secure-enabled which is a cutting-edge fraud prevention technology that allows for consumer authentication when making online payments. When using your Bybit Card, you can comfortably shop knowing that there’s an additional layer of security present to keep fraudsters at bay.

24/7 Multilingual Customer Service

As a customer-centric platform, Bybit ensures there’s 24/7 multilingual customer support for all its products, including the Bybit Card. We have a team of dedicated live agents to address any questions, concerns or inquiries related to your Bybit Card.

Loyalty Rewards Program

Bybit Card’s exciting Loyalty Rewards Program lets you earn Bybit Card Loyalty points every time you pay using our crypto debit card. Depending on the Loyalty points accumulated, you can redeem them for different rewards.

Convenient Off-ramping

Bybit has over 20 trading products available on the exchange including Spot Trading, Derivatives, Bybit Earn and Margin Trading. With the Bybit Card, you can easily and quickly off-ramp your earnings and spend them to make online payments.

How to Use Bybit Card

You can use the Bybit Card with online retailers and merchants all across the globe. Any illegal use associated with your Bybit Card may result in termination. Currently, we support both virtual and physical Bybit Cards. With a Virtual Bybit Card, you can make online payments once you have applied successfully, while a physical Bybit Card allows you to make online payments as well as contactless payments in retail stores using POS terminals that support contactless payments.

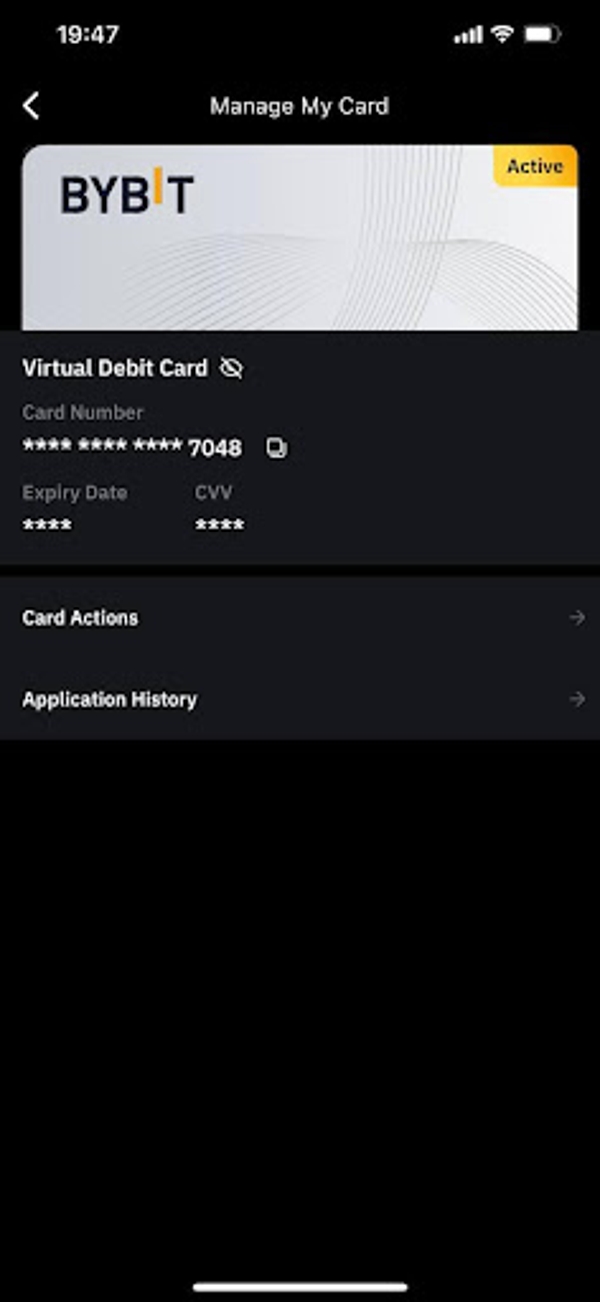

Activating Bybit Card

Your virtual Bybit Card is activated automatically and is available for immediate use once your application is successful. You’ll also not need to activate foreign transactions separately. There’s currently only one tier available, thus you can’t upgrade your Bybit Card tier for now, but we’re working to add VIP card tiers and will announce immediately when the new tiers are up.

Managing Funds

Managing funds on your Bybit Card is straightforward. It is, however, important to understand how your funds are deducted during payments, especially during times when you have insufficient fiat in your account.

Adding Funds

The Bybit Card doesn’t have a separate wallet. As such, it uses the balance in your Bybit Funding Account. To add funds to your Funding Account, you can use the Buy Crypto option or deposit crypto from other platforms/wallets.

Fund Deductions During Payments

When making a transaction using the Bybit Card, the fiat currency is automatically denominated based on your Proof of Address (POA) indicated during your Know Your Customer (KYC) level 2 process.

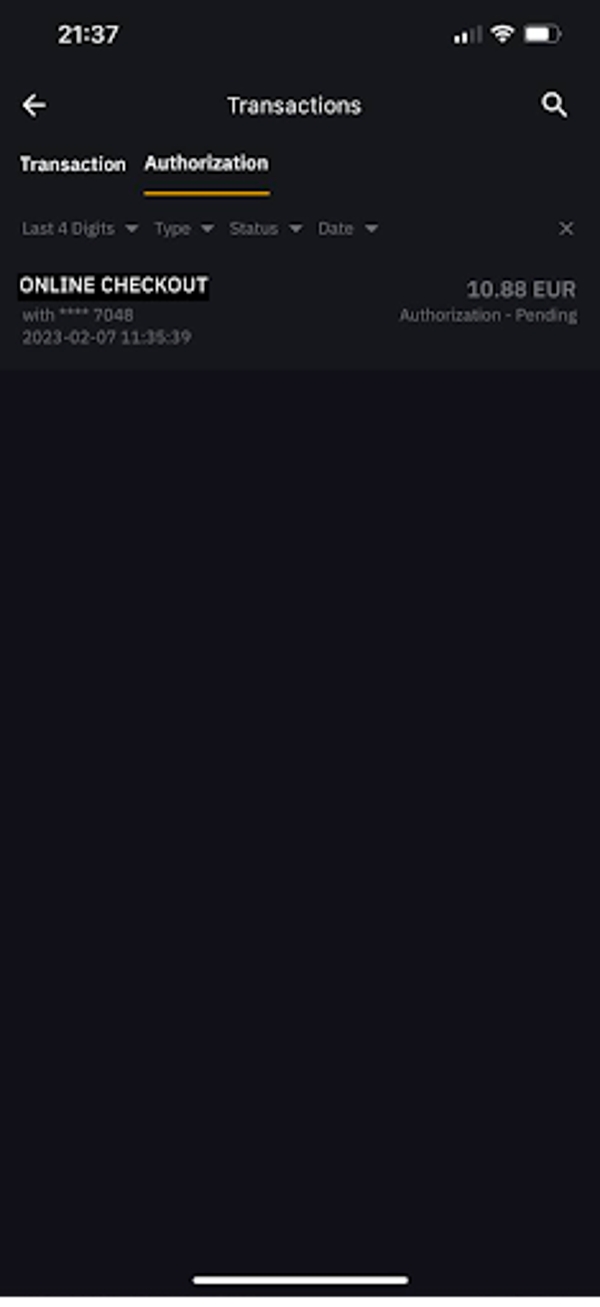

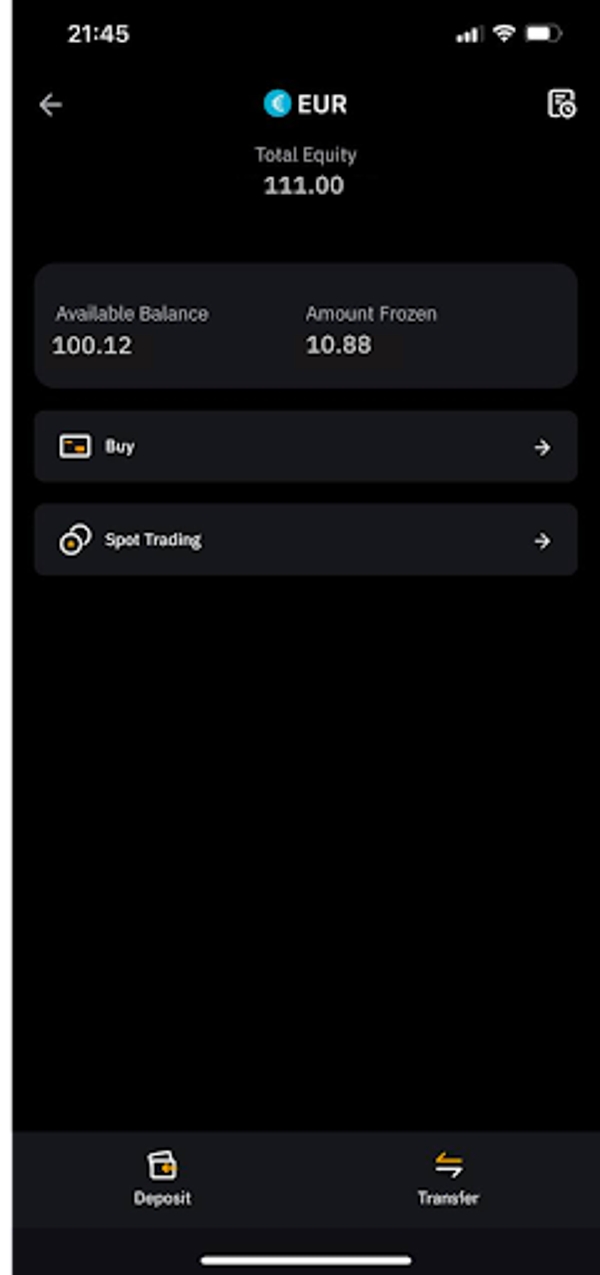

Once you pay using your crypto debit card and the transaction is authorized, the amount spent will be frozen in your Funding Account and deducted once the merchant completes the transaction.

Should the merchant cancel (aka reverse) prior authorization or refund the transaction, the frozen amount will be returned to your Funding Account’s Available Balance.

In a situation where there’s not enough fiat in your Funding Account to complete the transaction, your chosen crypto in your account will be converted to fiat to cover the deficit. Note that there will be a crypto-to-fiat conversion fee based on the Spot rate as well as a 0.9% Bybit Card crypto conversion fee.

The minimum amount for crypto conversion is 1 EUR/USD. If the product costs less than the minimum amount, a 10 EUR equivalent of USDT will still be converted, and the remaining EUR will be added to the fiat balance of the Funding Account.

The payment will automatically be denominated in the currency on your card even if you’re making foreign transactions. If you purchase a product that is charged in foreign currency, your funds will be deducted according to Mastercard’s foreign exchange rate plus the Bybit Card foreign exchange fee of 0.5% for EEA and 1% for Australia. For more information on the exchange rate, refer here.

Insufficient Funds

When there’s insufficient crypto and fiat in your Funding Account, the transaction will be declined. In case of insufficient funds, you can top up your Funding Account either through the Buy Crypto feature or the direct deposit of crypto from external platforms or wallets through the Bybit dashboard.

Making Transactions

Here are the five simple steps you need to take to pay using your Bybit Card:

- Obtain your virtual card details (i.e. card number, cvv, expiry date) from the Card Dashboard on your Bybit Account.

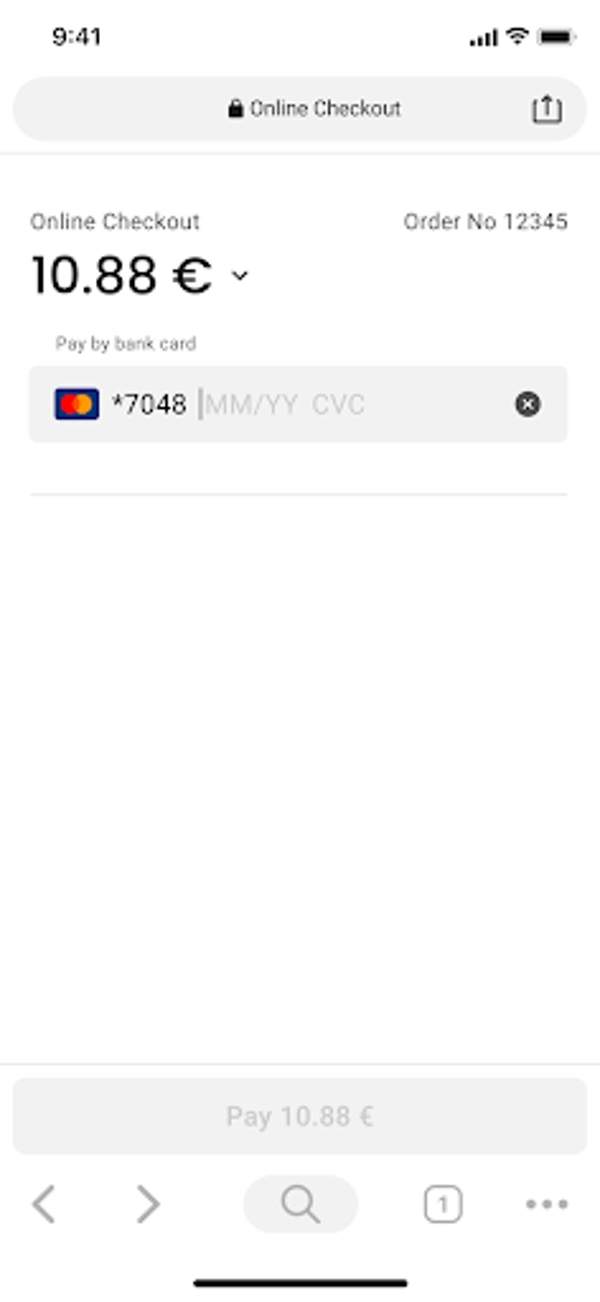

2. Input your card details on any online sites that support Mastercard.

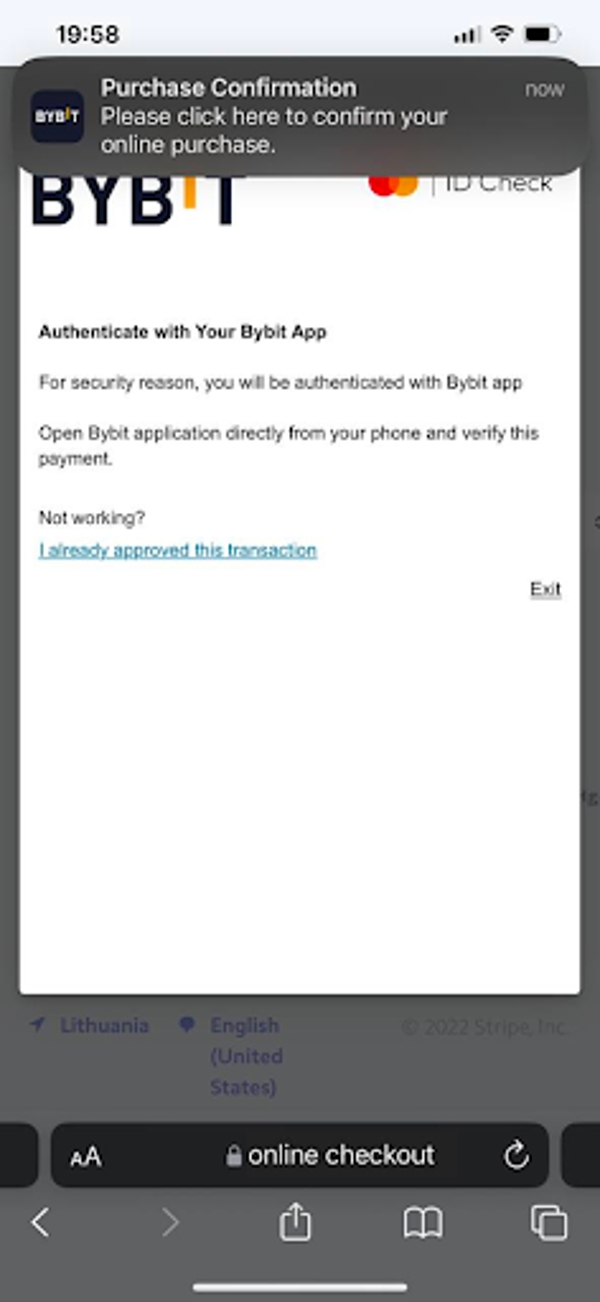

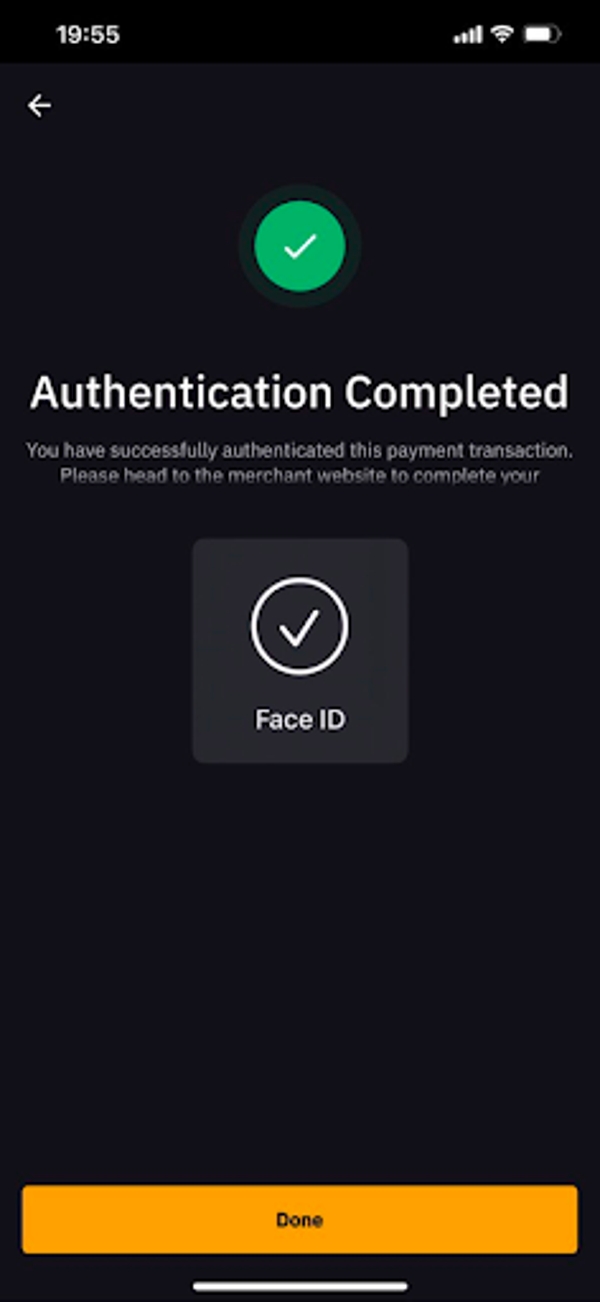

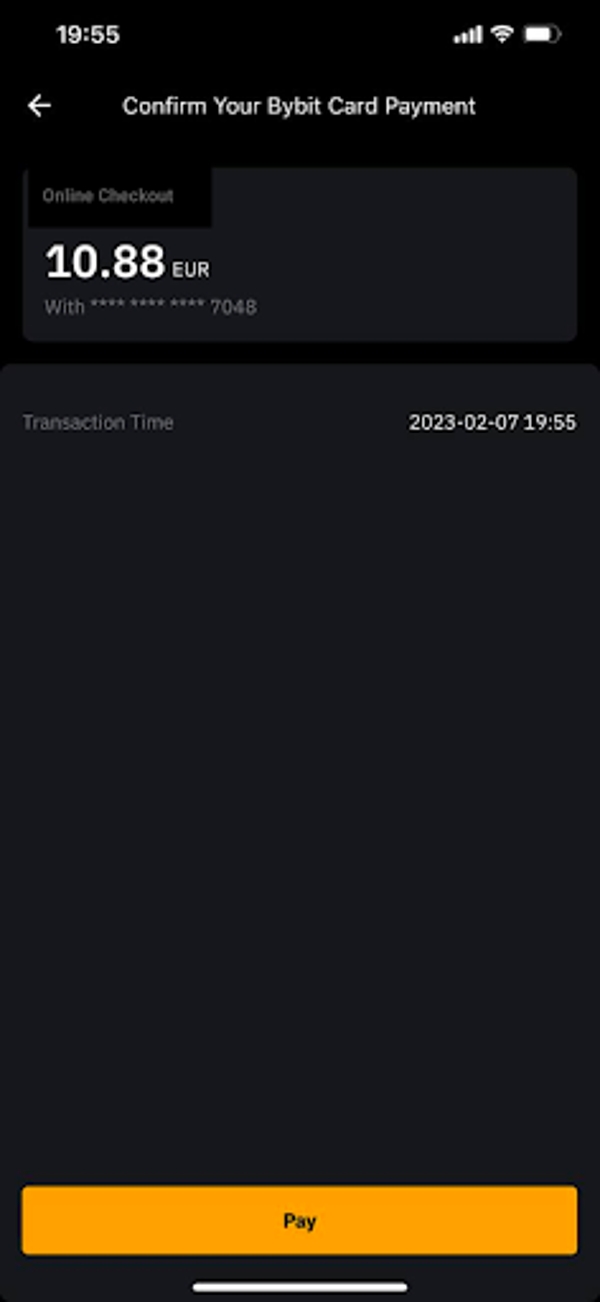

3. Proceed to make payment. Depending on the merchant, you might be required to perform an authentication of the transaction. You would be prompted to authenticate via the Bybit App. Note: Remember to allow notifications for Bybit App.

4. Once you’ve successfully authenticated the transaction, return to the merchant’s website to complete the payment.

5. If payment is successful, the amount is then frozen in your Funding Account, and the transaction would be in a pending status until it is completed by the merchant (usually takes a day, but up to 7 days).

Disputing Transactions Made With The Bybit Card

In case of a dispute for a transaction you’ve made, we highly recommend that you reach out directly to the merchant to request a refund.

If you do not recognize any particular transaction, or otherwise suspect that your card credentials may have been compromised, proceed to freeze your crypto debit card immediately and contact our Customer Support within 45 days of the transaction for further assistance.

Ways To Protect Yourself From Debit Card Frauds

As cybersecurity crimes continue to get sophisticated, it’s important to learn how to detect and protect yourself from debit card fraud. It’s easy to detect suspicious activity on your Bybit Card – you’ll notice funds missing in your Funding Account balance.

Since your Bybit Card is available virtually, you need to stay alert for any fraudulent activities. Here are some ways to help you prevent fraudulent activities on your Bybit Card:

- Avoid saving your passwords and credentials on your personal or work gadgets

- Avoid installing apps that allow third parties to have remote access to your device

- Conduct all transactions over a secured network

- Enable authentication prompts and push notifications to ensure that you’re authorizing the right transaction

- Don’t share your card information with anyone, especially on social media

- Beware of online phishing scams

- Regularly check your transaction history to keep track of transactions

- Contact the Bybit Card Customer Care when you suspect any suspicious activity on your account

Conclusion

Using a crypto debit card increases the liquidity of your digital assets and provides you the convenience of spending cryptocurrencies in your daily life. Whether you’re paying bills or buying goods online, Bybit Card will help you maximize your crypto usage while keeping your funds safe. Issued in partnership with Mastercard, you can spend your preferred cryptocurrencies anywhere the merchant has displayed the company’s logo. Furthermore, Bybit Card is easy to use with its intuitive mobile app. Try out the Bybit Card today for an efficient way to manage your digital assets on the go!

Bybit Card is a Mastercard debit card that allows easy and secure access to your funds wherever and whenever making it the ultimate companion on your crypto journey.

Yes, adding your Bybit Card to Google Pay is now available on Android. To do so, simply open your Bybit App and on the Bybit Card page, tap on Card → Add to Google Pay, complete the security verification, and follow the instructions on your Google Pay app.

Supported fiat currencies: EUR or GBP (based on your Address Verification during Bybit Card application)

Yes, you can change the number added in the Bybit Card for future Bybit Card transactions.

Yes. However, you must first obtain a virtual Bybit card before you can apply for a physical card. Please note that there is an issuance fee for the physical card.

Bybit Card is valid for 3 years. The virtual Bybit Card will be automatically renewed after expiration.